Telones (in Greek) & Publicanus, means the Tax

gatherers. That is the core word of my essay, today.

Tax has become the most

famous or the key word mostly used amongst the business community, mass, small,

or medium in this modern era we live. I felt that some of the entrepreneurs do not really please with the ‘taxations’

or it’s collecting methodologies.

Tax has become the most

famous or the key word mostly used amongst the business community, mass, small,

or medium in this modern era we live. I felt that some of the entrepreneurs do not really please with the ‘taxations’

or it’s collecting methodologies.

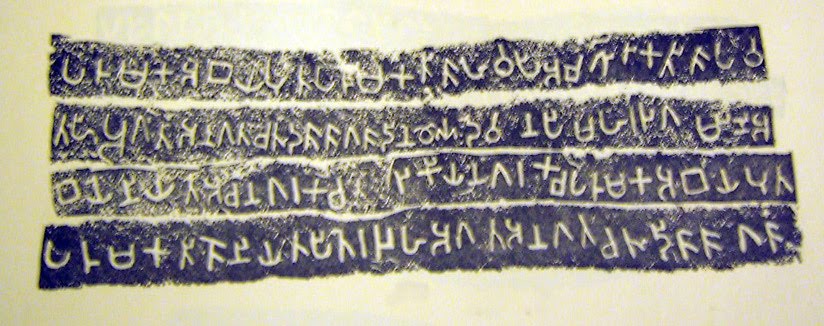

The tax is not really a modern term invented

by the modern entrepreneur communities, government tax departments, revenue officers;

the age of this component is really ancient & is not something that entered

into the modern day world recently. The Shape and size of this term, ‘tax’, actually

has changed over years. In the very ancient days, the kings, the emperor used

this method to collect some income from their peasants, farmers but the face

and features of this term then was very different compared to the features and

most importantly its practices, procedures.

During the colonization, the face of it and the

practices were again different to the practices used in the ancient societies.

This is not something very significant or applicable only to the societies, communities,

countries of this region, but is something, applicable to all the ‘colonies’ of

then, recent past and it was something that the imperials used to earn income,

their plates of ham and bacon, fill their treasuries, to cover all their inland

living & other expenses, other than what they earned from the resources

avail at that time. The percentages of tax payments that the peasants, farmers

should pay to the rulers were decided by them, the rulers, and the imperials. Some

of the practices introduced during the colonization were further continued and practiced

even after gaining independence.

The rebels arose against every type of taxation was something

very prominent and was significant in the histories worldwide, not only in Sri

Lanka. That is the draft, summarized history of this component ‘tax’, tax

payees, tax gathers.

What are the stories we hear, today, regarding taxes

& Enterprise / Businesses?

What are the differences the citizens can think of this

term, compared the days, ancient and modern, here and there of this world?

I think this is something the communities of

enterprises fear of. The Reason is apparent,

sometimes.

I do not think that the tax departments wait till the enterprise

grows to collect taxes. The Tax is something very heavily discussed, during budgetary

readings and even after.

The amount, Income Tax that a person, company, group

should pay vary according to the type & the size of the business, the laws

describe things clearly. Yet, are those laws ‘human friendly’? ‘Business

friendly’, entrepreneur friendly OR is it government Tax department friendly? This

is something that needs to be discussed at every level.

Heavy taxes needless to say is something which slower

the growth of enterprises. Some of the modes of taxes are very clearly defined

and mostly, is it very clear to the tax payee and aware of what amount they are

paying and for what? For instances ‘VAT, all and every import and export taxes.

Compared to those days of the country,

today there is a group that shows their interests to set up, implement business

of their own but fear of these taxes. How are we going to address this issue, especially

if the government wants likes to promote local businesses other than the

businesses of others? For instance CEPA.

I do not know that whether ‘high taxes’ are a myth that

the modern governments indulge in ‘thinking ‘it is the only way to earn income

for the government’, or is it a tradition they want to continue, practice, looking

at any model outside to country?

Needless to say ‘even a tiny enterprise implemented by

any individual , group / s is a helps not only for the governments, economies

of countries, job seekers , by providing jobs for seekers, linking other business

communities global, bringing in foreign currencies , but what some of these

groups or individuals get in return other tax receipt as punishments?

What some question is ‘why the governments do not

support the communities with business interests but always come behind them

after implementing a business using the

loans they have taken facing series of ‘ability to pay back tests’ of the banks

/ money lenders?

What are the indirect taxes they pay?

Stamp fees, the ‘interest rates’ they pay for the loans

they have taken from the banks, (capital) the rates they pay for their ‘

commodities’ equipment, products, materials , machines, office equipment,

they purchase or need before begin an enterprise, before establish a factory,

office, etc , other than the amounts they should allocate for the rents, salaries of the human resources etc.

So, if you calculate the total amount of money they,

the business communities pay as direct taxes and indirect taxes you would aware

that it is not just a tiny amount but is a huge amount. This directly or

indirectly affects the business communities, small, medium or large or massive.

According to some (surveyed / researched) the labor

here is cheap and the availability of some of the resources, entity spaces, is cheaper

here, so I guess naturally the foreign investors show interests to base here. Yes, it is true that there are benefits that

the countries can get by following such systems within, but how does it affect

the local business communities, small & medium entrepreneurs?

What relief that the tax departments, relevant

officials, policy makers could think of giving the business communities other than

coming to their premises to collate taxes and with fine lists

Let’s help the already established business entities,

the entities to be established in the future, for the sustainability of their businesses

by reducing or adjusting the rates of the taxes they needs to pay and by moderating

the laws already in books.

To be continued ………………

No comments:

Post a Comment